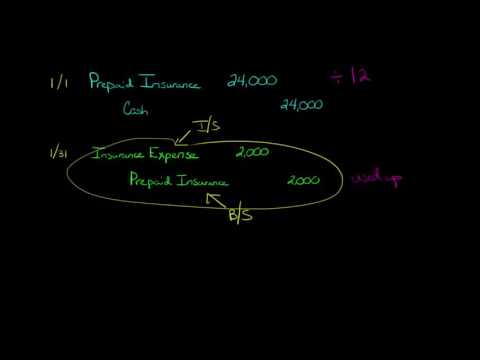

Prepaid Insurance

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 15

Lesson

Comments

Related Courses in Business

Course Description

Prepaid expenses is the money set aside for goods or services before you receive delivery. Other current assets are cash and equivalents, accounts receivable, notes receivable, and inventory.Do prepaid expenses convert to cash?

Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.Are prepaid expenses Accounts payable?

Prepaid expenses refer to advance payments for business expenses, while debts owed by a company in the course of its trade are called accounts payable. Each transaction is completely different from the other, but each has a direct effect on the movement of money into or out of a business.Is prepaid rent accounts receivable?

Definition of Rent Receivable

Prepaid rent typically represents multiple rent payments, while rent expense is a single rent payment. So, a prepaid account will always be represented on the balance sheet as an asset or a liability. When the prepaid is reduced, the expense is recorded on the income statement.

Trends

French

Graphic design tools for beginners

Data Science and Data Preparation

Artificial intelligence essentials

Formation efficace à l écoute de l

Learning English Speaking

Electrical engineering for engineer

Essential english phrasal verbs

MS Excel

Build a profitable trading

Python for beginners

American english speaking practice

Build a tic tac Toe app in Xcode

Figma for UX UI design

Marketing basics for beginners

ArrayLists in C for beginners

Web Design for Beginners

Computer science careers

Magento Formation Français

Ubuntu linux

Recent

Data Science and Data Preparation

Growing ginger at home

Gardening basics

Ancient watering techniques

Grow mushrooms

Growing onions

Veggie growing

Bean growing at home

Growing radishes

Tomato growing at home

Shallot growing

Growing kale in plastic bottles

Recycling plastic barrel

Recycling plastic bottles

Grow portulaca grandiflora flower

Growing vegetables

Growing lemon tree

Eggplant eggplants at home

zucchini farming

watermelon farming in pallets