Risk Factors for Accounting Fraud

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 27

Lesson

Comments

Related Courses in Business

Course Description

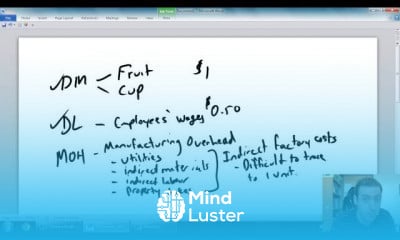

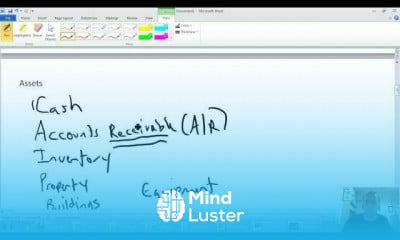

Financial statement analysis is the process of analyzing a company's financial statements for decision-making purposes. External stakeholders use it to understand the overall health of an organization as well as to evaluate financial performance and business value.Financial statement analysis is the process of reviewing and analyzing a company's financial statements to make better economic decisions to earn income in future. These statements include the income statement, balance sheet, statement of cash flows, notes to accounts and a statement of changes in equity.What are the types of financial statement analysis?

Types of Financial Analysis

#1 – Horizontal Analysis. ...

#2 – Vertical Analysis.

#3 – Trend Analysis.

#4 – Liquidity Analysis. ...

#5 – Solvency Analysis.

#6 – Profitability Analysis.

#7 – Scenario & Sensitivity Analysis.

#8 – Variance Analysis.Why is financial statement analysis important?

It provides internal and external stakeholders with the opportunity to make informed decisions regarding investing. Financial statement analysis also provides lending institutions with an unbiased view of a business's financial health, which is helpful for making lending decisions.

Trends

French

Graphic design tools for beginners

Artificial intelligence essentials

Formation efficace à l écoute de l

Essential english phrasal verbs

MS Excel

Build a profitable trading

Electrical engineering for engineer

Data Analytics Visualization Techniques

YouTube channel setup

Python programming language

Magento Formation Français

Build a tic tac Toe app in Xcode

Excel skills for math and science

Computer science careers

Learning English Speaking

Printing student ID cards with excel tools

Python for beginners

Figma for UX UI design

Web Design for Beginners

Recent

Growing ginger at home

Gardening basics

Ancient watering techniques

Grow mushrooms

Growing onions

Veggie growing

Bean growing at home

Growing radishes

Tomato growing at home

Shallot growing

Growing kale in plastic bottles

Recycling plastic barrel

Recycling plastic bottles

Grow portulaca grandiflora flower

Growing vegetables

Growing lemon tree

Eggplant eggplants at home

zucchini farming

watermelon farming in pallets

pineapple farming