Days Sales Outstanding Average Collection Period

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 28

Lesson

Comments

Related Courses in Business

Course Description

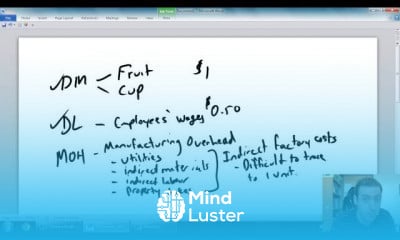

A financial ratio or accounting ratio is a relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization.What are the five financial ratios?

There are five basic ratios that are often used to pick stocks for investment portfolios. These include price-earnings (P/E), earnings per share, debt-to-equity and return on equity (ROE)

In general, financial ratios can be broken down into four main categories—1) profitability or return on investment; 2) liquidity; 3) leverage, and 4) operating or efficiency—with several specific ratio calculations prescribed within each.What are ideal financial ratios?

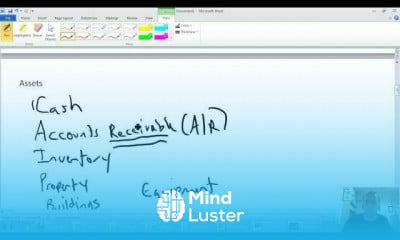

#1 – Current Ratio

The Current ratio. Current ratio = current assets/current liabilities read more is referred to as a working capital ratio or banker's ratio. ... The ratio of 1 is considered to be ideal that is current assets. It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable,

Trends

French

Formation efficace à l écoute de l

Graphic design tools for beginners

Data Science and Data Preparation

Learning English Speaking

American english speaking practice

Build a profitable trading

Essential english phrasal verbs

MS Excel

Artificial intelligence essentials

Electrical engineering for engineer

VBA macros in excel for beginners

Magento Formation Français

Build a tic tac Toe app in Xcode

AI workflow automation

Figma for UX UI design

Building a website with chatGPT

ArrayLists in C for beginners

FREE MUSIC THEORY

YouTube channel setup

Recent

Data Science and Data Preparation

Growing ginger at home

Gardening basics

Ancient watering techniques

Grow mushrooms

Growing onions

Veggie growing

Bean growing at home

Growing radishes

Tomato growing at home

Shallot growing

Growing kale in plastic bottles

Recycling plastic barrel

Recycling plastic bottles

Grow portulaca grandiflora flower

Growing vegetables

Growing lemon tree

Eggplant eggplants at home

zucchini farming

watermelon farming in pallets