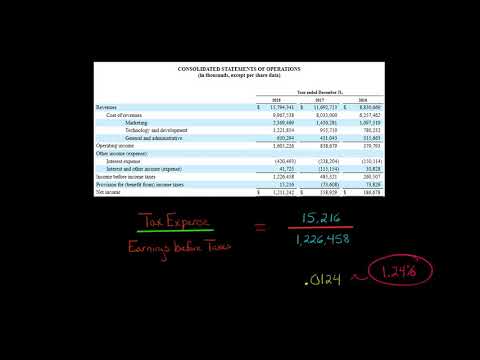

How to Calculate the Effective Tax Rate

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 12

Lesson

Comments

Related Courses in Business

Course Description

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. ... Personal income tax is a type of income tax that is levied on an individual's wages, salaries, and other types of income.

Income tax is defined as money the government takes out of your earnings in order to pay for government operations and programs. Fifteen percent of your income deducted from your paycheck and paid to the government to maintain the military and social welfare programs is an example of income tax.What is income in income tax?

Income from wages, salaries, interest, dividends, business income, capital gains, and pensions received during a given tax year are considered taxable income in the United States. ... In most countries, earned income is taxed by the government before it is received.

Trends

French

Graphic design tools for beginners

Formation efficace à l écoute de l

Data Science and Data Preparation

Artificial intelligence essentials

Learning English Speaking

Essential english phrasal verbs

MS Excel

Electrical engineering for engineer

Build a profitable trading

American english speaking practice

Build a tic tac Toe app in Xcode

Python for beginners

Design and Analysis of algorithms DAA

Marketing basics for beginners

YouTube channel setup

Figma for UX UI design

Web Design for Beginners

Magento Formation Français

Computer science careers

Recent

Data Science and Data Preparation

Growing ginger at home

Gardening basics

Ancient watering techniques

Grow mushrooms

Growing onions

Veggie growing

Bean growing at home

Growing radishes

Tomato growing at home

Shallot growing

Growing kale in plastic bottles

Recycling plastic barrel

Recycling plastic bottles

Grow portulaca grandiflora flower

Growing vegetables

Growing lemon tree

Eggplant eggplants at home

zucchini farming

watermelon farming in pallets