Accounting for Franchise Fees

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 8

Lesson

Comments

Related Courses in Business

Course Description

What are the four criteria for revenue recognition?

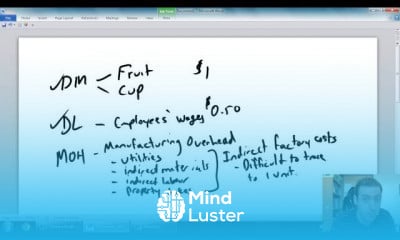

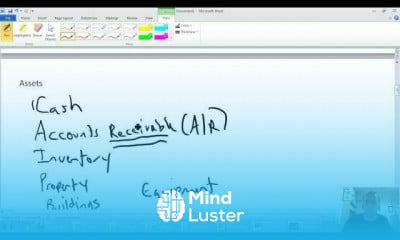

The staff believes that revenue generally is realized or realizable and earned when all of the following criteria are met:

Persuasive evidence of an arrangement exists,3

Delivery has occurred or services have been rendered,4

The seller's price to the buyer is fixed or determinable,5 ...

Collectibility is reasonably assured.What is revenue recognition with example?

What is the Revenue Recognition Principle? The revenue recognition principle states that one should only record revenue when it has been earned, not when the related cash is collected. For example, a snow plowing service completes the plowing of a company's parking lot for its standard fee of $100.How is revenue Recognised?

According to the principle, revenues are recognized when they are realized or realizable, and are earned (usually when goods are transferred or services rendered), no matter when cash is received. In cash accounting – in contrast – revenues are recognized when cash is received no matter when goods or services are sold.

Trends

French

Graphic design tools for beginners

Data Science and Data Preparation

Formation efficace à l écoute de l

Artificial intelligence essentials

Learning English Speaking

Essential english phrasal verbs

MS Excel

Electrical engineering for engineer

American english speaking practice

Build a profitable trading

Build a tic tac Toe app in Xcode

Python for beginners

Figma for UX UI design

YouTube channel setup

Marketing basics for beginners

Web Design for Beginners

Computer science careers

Magento Formation Français

ArrayLists in C for beginners

Recent

Data Science and Data Preparation

Growing ginger at home

Gardening basics

Ancient watering techniques

Grow mushrooms

Growing onions

Veggie growing

Bean growing at home

Growing radishes

Tomato growing at home

Shallot growing

Growing kale in plastic bottles

Recycling plastic barrel

Recycling plastic bottles

Grow portulaca grandiflora flower

Growing vegetables

Growing lemon tree

Eggplant eggplants at home

zucchini farming

watermelon farming in pallets