Units of Production Depreciation Method

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 16

Lesson

Comments

Related Courses in Business

Course Description

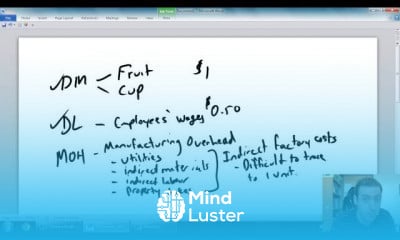

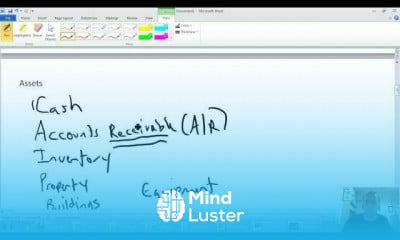

Property, plant, and equipment (PP&E) are a company's physical or tangible long-term assets that typically have a life of more than one year. Examples of PP&E include buildings, machinery, land, office equipment, furniture, and vehicles. Companies list their net PP&E on their financial statements.How do you calculate property, plant, and equipment?

To calculate PP&E, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. Next, subtract accumulated depreciation from the result.

tangible fixed assets

Definition: The property, plant, and equipment (PP&E) account, also known as tangible fixed assets, represents the non-current, physical, illiquid assets that are expected to generate long-term economic benefits for a firm including land, buildings, and machinery.

Trends

French

Graphic design tools for beginners

Data Science and Data Preparation

Formation efficace à l écoute de l

Artificial intelligence essentials

Learning English Speaking

Essential english phrasal verbs

MS Excel

Electrical engineering for engineer

American english speaking practice

Build a profitable trading

Build a tic tac Toe app in Xcode

Python for beginners

Figma for UX UI design

YouTube channel setup

Marketing basics for beginners

Web Design for Beginners

Magento Formation Français

Computer science careers

ArrayLists in C for beginners

Recent

Data Science and Data Preparation

Growing ginger at home

Gardening basics

Ancient watering techniques

Grow mushrooms

Growing onions

Veggie growing

Bean growing at home

Growing radishes

Tomato growing at home

Shallot growing

Growing kale in plastic bottles

Recycling plastic barrel

Recycling plastic bottles

Grow portulaca grandiflora flower

Growing vegetables

Growing lemon tree

Eggplant eggplants at home

zucchini farming

watermelon farming in pallets