Journal Entry for Depreciation

Hide All Ads - Subscribe Premium Service Now

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 16

Lesson

Comments

Related Courses in Business

Course Description

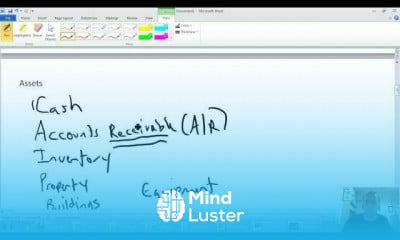

Property, plant, and equipment (PP&E) are a company's physical or tangible long-term assets that typically have a life of more than one year. Examples of PP&E include buildings, machinery, land, office equipment, furniture, and vehicles. Companies list their net PP&E on their financial statements.How do you calculate property, plant, and equipment?

To calculate PP&E, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. Next, subtract accumulated depreciation from the result.

tangible fixed assets

Definition: The property, plant, and equipment (PP&E) account, also known as tangible fixed assets, represents the non-current, physical, illiquid assets that are expected to generate long-term economic benefits for a firm including land, buildings, and machinery.

Trends

French

IT business analyst

Graphic design tools for beginners

Pray in arabic word by word

MS Excel

Digital Marketing From Scratch

Learning English Speaking

AWS For Beginners | Amazon AWS

AI for business analysis

Make money with openAI GPTs

10X coding tools for developers

Python programming language

Google Python class

French language for beginners

Formation efficace à l écoute de l

ChatGPT aPI for beginners

Marketing basics for beginners

IELTS

AUTOMATA THEORY

Python machine learning from scratch

Recent

IT business analyst

AI for business analysis

Building Ai businesses

ChatGPT aPI for beginners

AI tools for entrepreneurs

Create your own chatGPT with PDF

AI business

Make money with openAI GPTs

AI agency developer

AI agency fundamentals

AI agency for businesses

AI business strategy

AI sales automation

AI agency growth

Building an ai agency

AI industry analysis

AI business operations

AI service marketing essentials

Installing wordPress on Siteground

Siteground email marketing

You must have an account within the platform in order to participate in the discussion and comment. Register now for freeClick here