Tax Free Reorganizations in U S Corporate Tax

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 54

Lesson

Show More

Lessons

Comments

Related Courses in Business

Course Description

Business entities are either not taxed at all, or they are taxed at a corporate rate. If a business entity is classified as a pass-through tax entity, it does not pay income taxes. Rather, the business owners pay taxes on any business profits.How are business entities taxed?

Business entity tax obligations

Partnerships are pass-through tax entities. The business itself does not pay income taxes. The tax liability skips, or “passes through,” the business and falls onto the partners. Generally, partners pay taxes on business income based on how much of the business they own.

Trends

pyspark

python

Business Communication

Data Cleansing Techniques

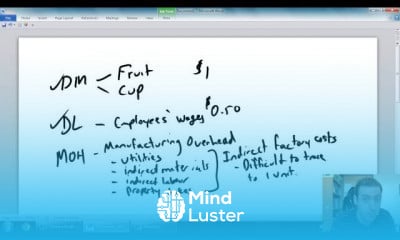

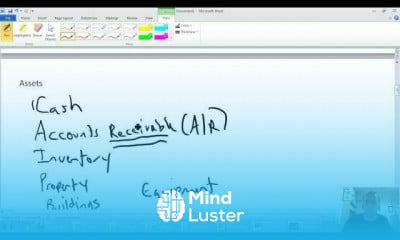

Cost Accounting Fundamentals

IBM SPSS Statistics

Python for Data Analytics Fundamentals

Pregnancy smoothie recipes ideas

Создание проекта 3D игры в unity

Spanish Lessons for Beginner Learners

Daily conversational English

Data Preparation in Data Science

Beginner Camera Test

Work Smart

LeetCode for data structures and algorithms

MS Excel

Dental drill techniques

Natural Language Understanding

CapCut video editing for beginners

What is compiler in C++

Recent

IELTS exam english

Business english vocabulary and idioms

Improve english vocabulary

Basic english grammar

Confusing english verbs

Prepositions in english

English tenses

Essential english phrasal verbs

British english grammar for beginners

Essential english idioms

British accents for beginners

English british pronunciation practice

British phrasal verbs

Essential business english phrases

British english pronunciation

English phrasal verbs

English alphabet pronunciation

English british traditions

British slang words

Advanced english vocabulary