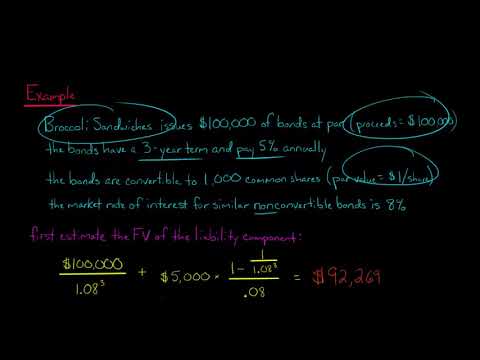

How to Account for Convertible Debt IFRS

Hide All Ads - Subscribe Premium Service Now

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 7

Lesson

Comments

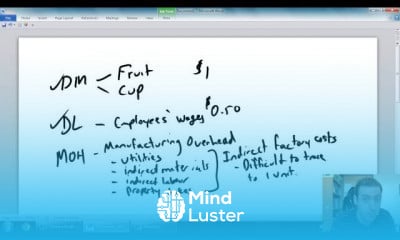

Related Courses in Business

Course Description

Examples of long-term liabilities are bonds payable, long-term loans, capital leases, pension liabilities, post-retirement healthcare liabilities, deferred compensation, deferred revenues, deferred income taxes, and derivative liabilities.What is long-term and short term liabilities?

Current liabilities (short-term liabilities) are liabilities that are due and payable within one year. Non-current liabilities (long-term liabilities) are liabilities that are due after a year or more. Contingent liabilities are liabilities that may or may not arise, depending on a certain event.

On a balance sheet, items that do not currently require interest payments, but will require payments in the future for a period of longer than one year. Common examples of other long-term liabilities include deferred taxes, future employee benefits, such as pensions for employees currently working, and lease payments.What is Total long-term liabilities?

Long-term liabilities, or noncurrent liabilities, are debts and other non-debt financial obligations with a maturity beyond one year. They can include debentures, loans, deferred tax liabilities, and pension obligations.

Trends

Graphic design tools for beginners

Workplace Communication skills for beginners

MS Excel

Communication Skills

Create cinematic ai landscapes videos

Google Python class

Create AI Videos

Python programming language

Basic mathematics

Logistic regression machine learning

Embedded Systems ES

Python machine learning from scratch

Cyber Security for Beginners | Edureka

French

French language for beginners

Engineering chemistry fundamentals

Java programming for beginners

Learning English Speaking

Excel fundamentals for finance

Contractions in english for beginners

Recent

Engineering chemistry fundamentals

Engineering thermodynamics

Mechanics

Electromagnetic theory

Thermometry

Basic mathematics

Create cinematic ai landscapes videos

Ai photography basics

Tools for ai image

Create ai videos with moonvalley

Leonardo Ai

Making ai cartoon animation

Create cinematic Ai videos

Create AI Videos

Creating AI videos

Runway gen 3 AI video generator

Logistic regression machine learning

Linear regression in python

Neural Network python

Optimization in deep learning

You must have an account within the platform in order to participate in the discussion and comment. Register now for freeClick here