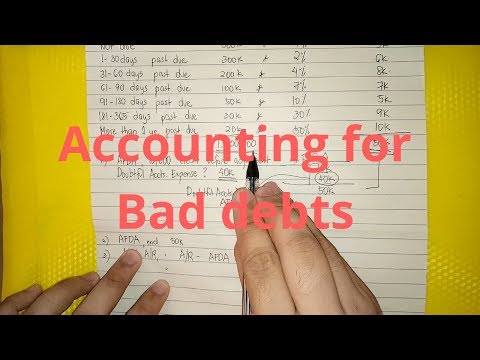

Accounting for Bad Debts Doubtful Accounts Allowance Method

Share your inquiries now with community members

Click Here

Sign up Now

Lesson extensions

Lessons List | 10

Lesson

Comments

Related Courses in Accounting

Course Description

Financial accounting principles course,

in this course we will learn about the financial accounting principles that are essential for preparing and understanding financial statements. We will delve into fundamental concepts such as the accrual basis of accounting, revenue recognition, and the matching principle, which are crucial for accurate financial reporting. Students will gain insights into key accounting frameworks including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). The course will cover the preparation of the primary financial statements: the balance sheet, income statement, and cash flow statement. Through practical examples and exercises, students will develop the skills to analyze and interpret financial information, ensuring they can apply these principles effectively in various accounting contexts.

Trends

Learning English Speaking

MS Excel

Python programming language

Web Design for Beginners

Communication Skills

English Language

Photo Editing

Excel Course Basic to Advanced

Make AI for beginners

Formation efficace à l écoute de l

Cyber Security for Beginners | Edureka

Content Marketing

Python in Hindi

French

Every Photoshop

Artificial intelligence tools

English Grammar for Beginners

IELTS exam english

Ethical Hacking

Create a custom List in excel

Recent

Power BI Fundamentals

Make AI for beginners

Power BI

Power BI UI UX design roadmap

Artificial intelligence tools

Create a custom List in excel

Spatie laravel media library

Install laravel livewire

Install Laravel 8 on windows 10

Laravel 8 admin panel

Laravel statamic CMS website

Laravel URL shortener

Laravel 8 API

Laravel livewire employees management

Employees management application with laravel

Vue js 3 fundamentals

Laravel livewire business listing

Laravel inertiaJS movie app

Vue router 4

Create a movie website with laravel Livewire