The 5 Factors of Section 385 for Classifying as Debt or Equity U S Corporate Tax

Share your inquiries now with community members

Click Here

Sign up Now

Lessons List | 54

Lesson

Show More

Lessons

Comments

Related Courses in Business

Course Description

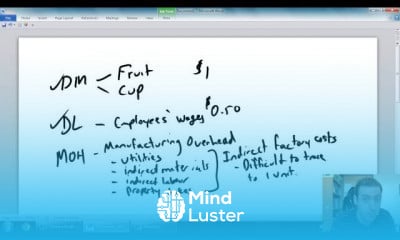

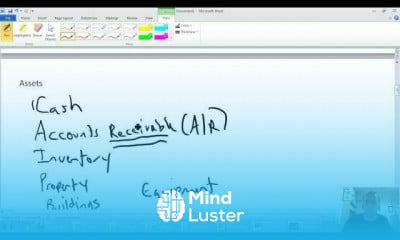

Business entities are either not taxed at all, or they are taxed at a corporate rate. If a business entity is classified as a pass-through tax entity, it does not pay income taxes. Rather, the business owners pay taxes on any business profits.How are business entities taxed?

Business entity tax obligations

Partnerships are pass-through tax entities. The business itself does not pay income taxes. The tax liability skips, or “passes through,” the business and falls onto the partners. Generally, partners pay taxes on business income based on how much of the business they own.

Trends

Data Cleansing Techniques

Business Communication

IBM SPSS Statistics

Daily conversational English

Beginner Camera Test

ANIMATE CC

Java Network Programming Recipes

AutoCAD drawing commands for beginners

Mathematics III in Mechanical Engineering

Angular For Beginners

Importing blocks from other files in autoCAD

CISSP Domain basics

People Management

C Level 2

CompTIA N10 008 Network for Beginners

Most Popular Meditation Topics

Glow effect editing in photoshop

Spanish Lessons for Beginner Learners

Planks with knee bend exercises

Data warehousing foundations

Recent

IELTS exam english

Business english vocabulary and idioms

Improve english vocabulary

Basic english grammar

Confusing english verbs

Prepositions in english

English tenses

Essential english phrasal verbs

British english grammar for beginners

Essential english idioms

British accents for beginners

English british pronunciation practice

British phrasal verbs

Essential business english phrases

British english pronunciation

English phrasal verbs

English alphabet pronunciation

English british traditions

British slang words

Advanced english vocabulary