تحميل Taxation of Business Entities

Business

روابط التحميل

يوجد صيانة لقسم تحميل الدورات لذلك يمكنك مشاهدة الدورة بشكل مباشر من هنا بدلا من التحميل لحين الانتهاء من صيانة القسم

-

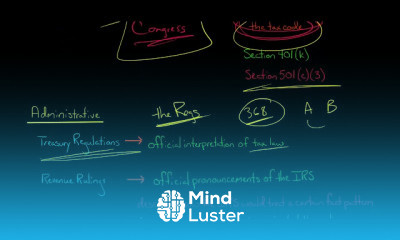

The 3 Sources of Federal Tax Law in the U S

-

The Different Types of Business Entities in the U S

-

Comparing Business Entity Types

-

Sole Proprietorships | Advantages and Disadvantages

-

Partnerships | Advantages and Disadvantages

-

C Corporations | Advantages and Disadvantages

-

S Corporations | Advantages and Disadvantages

-

LLCs | Advantages and Disadvantages

-

Section 351 Transaction U S Corporate Tax

-

Section 351 Transaction with the Transfer of Services U S Corporate Tax

-

Section 351 Transaction with Boot U S Corporate Tax

-

Section 351 transaction with Section 357 liabilities U S Corporate Tax

-

How to Calculate Transferor s Basis Section 351 U S Corporate Tax

-

How to Allocate Basis to Multiple Classes of Stock Section 351 U S Corporate Tax

-

How to Determine Holding Period of Stock in a Section 351 Transaction U S Corporate Tax

-

How to Calculate Corporation s Basis in a Section 351 Transaction U S Corporate Tax

-

How to Calculate Corporation s Basis per Section 351 with a Built in Loss U S Corporate Tax

-

The 3 Accounting Methods for Corporate Tax Returns U S Corporate Tax

-

3 Tax Advantages of Debt U S Corporate Tax

-

4 Tax Advantages of Using Equity U S Corporate Tax

-

After tax Cost of Debt vs Equity U S Corporate Tax

-

The 5 Factors of Section 385 for Classifying as Debt or Equity U S Corporate Tax

-

Earnings Stripping U S Corporate Tax

-

Section 1244 Stock U S Corporate Tax

-

Junk Bonds and Taxes The AHYDO Rules U S Corporate Tax

-

E P Earnings and Profits U S Corporate Tax

-

Current E P vs Accumulated E P U S Corporate Tax

-

How to Allocate E P to Multiple Distributions U S Corporate Tax

-

Section 301 Nonliquidating Distribution U S Corporate Tax

-

Qualified Dividends vs Ordinary Dividends U S Tax

-

Constructive Dividends U S Tax

-

Limitations on the Dividends Received Deduction U S Corporate Tax

-

Dividends Received Deduction U S Corporate Tax

-

Section 305 Taxability of Stock Dividends U S Corporate Tax

-

Section 302 Redemptions U S Corporate Tax

-

Redemptions vs Dividends U S Corporate Tax

-

Taxable Acquisitions in U S Corporate Tax

-

Tax Free Reorganizations in U S Corporate Tax

-

Type A Tax Free Reorganizations U S Corporate Tax

-

Forward Triangular Merger Type A Tax Free Reorganization U S Corporate Tax

-

Reverse Triangular Merger Type A Tax Free Reorganization U S Corporate Tax

-

Type B Tax Free Reorganization U S Corporate Tax

-

Type C Tax Free Reorganizations U S Corporate Tax

-

Type D Acquisitive Tax Free Reorganization U S Corporate Tax

-

Spin offs Split offs and Split ups U S Corporate Tax

-

Type D Divisive Reorganizations U S Corporate Tax

-

Consolidated Tax Return Requirements U S Tax

-

5 Advantages of Filing a Consolidated Tax Return U S Tax

-

5 Disadvantages of Filing a Consolidated Tax Return U S Tax

-

Excess Loss Account | Section 1502 U S Tax

-

Introduction to International Tax | U S Taxation

-

Subpart F Income of Controlled Foreign Corporations | U S Taxation

-

GILTI Global Intangible Low taxed Income | U S Taxation

-

Base Erosion Anti abuse Tax BEAT | U S Taxation

تحميل Taxation of Business Entities Business ، دروس تحميل Taxation of Business Entities ، تحميل برابط مباشر و مشاهدة تحميل Taxation of Business Entities ، تعليم الاطفال تحميل Taxation of Business Entities ، البداية لتعلم تحميل Taxation of Business Entities ، تحميل Taxation of Business Entities ، تحميل كورس تحميل Taxation of Business Entities

Trends

Learning English Speaking

MS Excel

Python programming language

Web Design for Beginners

Communication Skills

Excel Course Basic to Advanced

English Language

Photo Editing

IELTS exam english

Formation efficace à l écoute de l

Every Photoshop

Content Marketing

French

Python in Hindi

Embedded Systems ES

Основы after effects

Power BI metrics fundamentals

English Grammar for Beginners

Accounting

Java Programming Language